How to Use LivePlan to Manage Cash and Budget for Your Client’s Paycheck Protection Loan

Posted Kathy Gregory

Paycheck Protection Loan Update:

Congress has passed a third round of stimulus that goes into effect the week of January 11th. This includes $284 billion in relief funds for small businesses to be made available through the Paycheck Protection Program (PPP) and a slew of updates for the Economic Injury Disaster Loan (EIDL) program that go into effect on January 15, 2021. Click here to learn where you can apply for the new PPP funds and here for up-to-date information on the EIDL changes.

The passing of the Paycheck Protection Program (PPP) expansion provides some much-needed relief for small businesses struggling to survive through the COVID-19 crisis (and whatever comes next). Not only does it help them extend their cash runway, it will help them maintain their staff and cover needed expenses. As a strategic advisor you’ll need to help your small business clients plan for the loan and understand and manage their profit and cash going forward.

You can use LivePlan to do all of this work. Here’s how.

How to plan for a Paycheck Protection Loan with LivePlan

This guide will help you understand how to model the PPP loan in LivePlan, and develop a forecast, budget, and spending plan for your client. After that, use LivePlan every month to help your clients manage their business according to the plan you develop.

If you’re already a LivePlan Strategic Advisor, the monthly work we suggest here can be wrapped into your current service. You’ll use the forecast scenario you build here in your monthly tracking and reporting. If you aren’t a LivePlan Strategic Advisor, and would like to be, you can learn more here.

Here are the steps to plan for the use of a Paycheck Protection Loan. These steps can be modified for other SBA loans without forgiveness as applicable.

- Estimate your PPP loan amount

- Create a new forecast scenario

- Add the PPP loan to the forecast

- Complete a cash forecast, budget, and spending plan

- Apply for the loan and manage your business using the plan

Step 1. Estimate the amount of the Paycheck Protection loan

The first step is to estimate the maximum amount your client’s business will qualify to borrow under the Paycheck Protection Program. The loan is intended to cover payroll costs and a portion of operating expenses, and only a certain percent of it (check current legislation) may be used for qualifying expenses other than payroll.

- Sum your total payroll costs from the prior year. You can find these in your accounting solution, or if LivePlan is connected and mapped to your accounting solution, you can use LivePlan Dashboard reports: Profit and Loss, and Personnel Breakdown.

- At this step, it’s enough to estimate the loan, for the purposes of planning. Exact figures will need to be gathered for the loan application. Viable payroll costs include: Salaries, wages, and commission

ii. Cash tips

iii. Vacation, family, medical, or sick leave payments

iv. Group health benefit insurance premiums

v. Retirement benefits

vi. Allowance for dismissal or separation

vii. State and local taxes based on employee compensation

viii. Employee costs – ie. cost of remote tools, equipment, transportation, etc. - The loan amount is based on 2 ½ months of payroll costs, so you’ll need to multiply the average of the last 12 months of payroll costs by 2.5. That’s your number for planning purposes.

Note: Not all payroll costs are valid under the Paycheck Protection Program, including the following:

- Individual employee compensation in excess of $100,000 for an annual salary.

- Payroll taxes, railroad retirement taxes, and income taxes.

- Any compensation given to an employee whose primary place of residence is located outside of the United States.

- Qualified sick leave wages under section 7001 or qualified family leave wages under section 7003 of the Families First Coronavirus Response Act for which a credit is allowed.

See this article for specifics and updates as we learn them.

Step 2: Create a new forecast scenario for the PPP loan

In this section you’ll create a forecast for this loan scenario. Start at the step that matches your current LivePlan Forecast status.

- If you already have a LivePlan forecast that starts at the beginning of the current fiscal year, you’re ready to go. You might want to create a new forecast scenario just for this PPP scenario. To do that, use the drop down above the Forecast tab and select Create a New Forecast, based on your current one. Then, jump to step E below.

If your forecast doesn’t start at the beginning of the fiscal year your current year you can either change the start date of your Forecast in the Options page of your Company, or you can archive this Company, and create a new Company. Pick C or D below for that.

If your forecast doesn’t start at the beginning of the fiscal year your current year you can either change the start date of your Forecast in the Options page of your Company, or you can archive this Company, and create a new Company. Pick C or D below for that.- If you don’t have a forecast now and your LivePlan Company is connected to an accounting solution use the drop down above the Forecast tab and Create a New Forecast based on your accounting data. This will populate your new forecast with last year’s actual accounting figures and also populate Beginning Balances. Name it PPP, or whatever name makes sense for you.

- If you don’t have a forecast now and your LivePlan Company is NOT connected to an accounting solution, you can create a Forecast manually. Use the drop-down above the Forecast tab and Create a New Forecast from scratch. Name it PPP, or whatever name makes sense for you. In this version you’ll need to enter your beginning balances in Forecast/Balance Sheet/Beginning Balances.

- Finish your starting forecast by updating any forecast months prior to now with what actually occurred. This will keep your profit and cash balances as close to accurate as possible. Enter these updates into the Financial Tables for each month.

- Finish this section by checking that your Beginning Balances are accurate, in Forecast/Balance Sheet/Beginning Balances. If you created your forecast from accounting data, these balances are populated for you. If you created your forecast manually, you’ll need to enter them.

Step 3: Add the PPP loan to the forecast

In this section, you’ll add your PPP loan to the forecast. The accounting steps for a PPP loan are multiple due to the forgiveness, and deferred payments on any remaining portion. In forecasting, you don’t have to model accounting transactions. More often than not you can skip to the final result – what you expect will happen and what the outcome will be for the business. This is how forecasting helps us understand future financial outcomes.

For the PPP loan, it’s best to start with a regular loan until you understand the forgiveness portion. When you learn what your forgiveness amount will be, you can remove the loan and enter the forgiveness in LivePlan as a cash investment. Follow these steps.

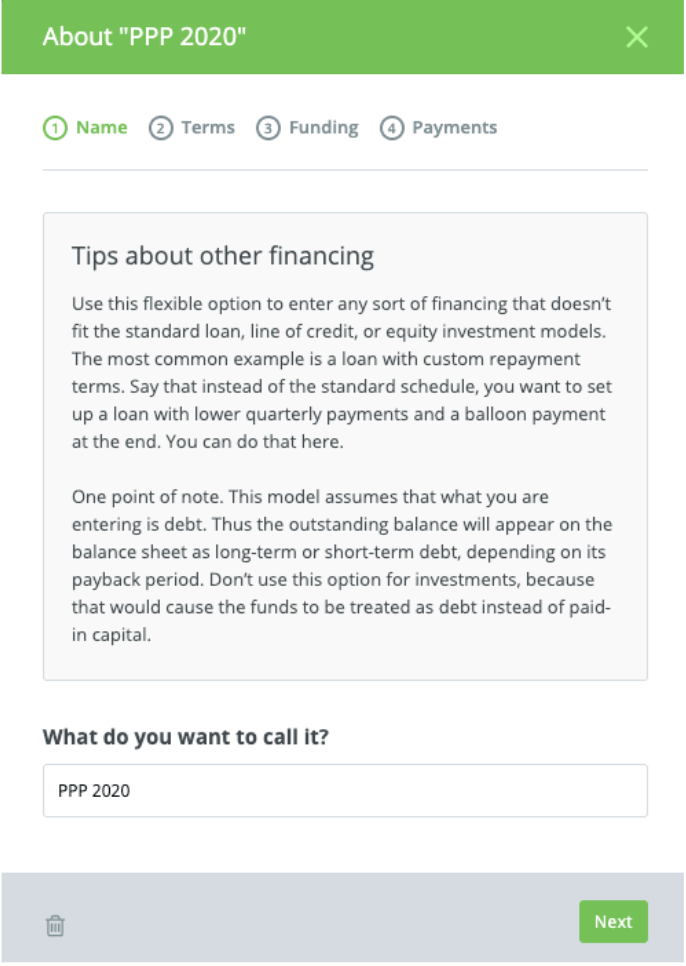

- In the Financing section of the Forecast tab, select Other Loan.

- Name the Loan PPP2020 (or whatever you’d like).

- Enter an interest rate of 0% for now. Once you’ve built your budget and cash plan you’ll know more about how much you expect to be forgiven. For now plan for your entire loan amount to be forgiven.

- Select “Yes” when prompted “If you expect to pay back within 12 months.” This can also be edited after you create your plan.

In the date choices, enter the full value of your eligible loan amount in the month you expect to receive it.

In the date choices, enter the full value of your eligible loan amount in the month you expect to receive it.- Make the payment 0. Leave the payments at 0 until you know about forgiveness. Note that your Forecast has automatically updated to include the loan as added cash and liability. Your loan is a liability until it’s forgiven.

- When you receive forgiveness for your loan (or you know enough from your plan or your bank to model it), you can remove the 0% interest loan and add an Investment entry to LivePlan. Be sure to use the date you received the loan as your investment date. This will keep the cash in the right month, and treat it as Paid In Capital.

- If you have any PPP loan amount that you expect not to be forgiven, you’ll carry the loan as a liability and pay it off. Enter this as an “Other” loan at 1% interest. Interest accrues from origination, but payments are deferred for 6 months, so use the monthly payment editor to enter payments in the right months, based on origination.

Step 4: Complete a cash forecast, budget and spending plan

Now that your forecast includes the loan, it’s time to make edits to develop a positive cash flow and a budget and spending plan that maximizes the loan. The revenue and expense forecast will act as the business’s budget, and the cash forecast will show the spending plan. The expense budget will also help to identify expenses that qualify for loan forgiveness.

- Enter forecast values in each of the Financial Tables through 2020. This is where you’ll need to use your best-educated guesses for your sales and related expenses in the coming months. And also be mindful of qualifying versus non-qualifying loan-related expenses. See this article for a full breakdown of expenses. Work through each of the following sections:

- Revenue (or sales) – use the revenue types to help you plan. Be conservative here, and only enter revenue you feel really confident about. You need to forecast how COVID-19 has affected your sales and show the trend down, so you may have many consecutive months with no revenues.

- Cost of Goods – base these on revenues

- Expenses – utilities and rent could be forgivable if they are under 25% of your total loan amount

- Personnel – the loan requires you to keep the same FTE (headcount) you had prior to receiving the funds, and in fact is the purpose of the PPP. You can reduce payroll up to a certain percent (see current specifics of the legislation) and still qualify for forgiveness, but you must have the same FTE. This is why it is important to model your personnel against your new lower revenue projections. You need to understand whether you should get the PPP loan and how not reducing staff at all affects your profits and cash. Note: At the time of this writing the PPP loan is unclear about contractor pay. In your LivePlan forecast, you can choose between On Staff (for payroll employees) and Contractor.

- Assets, Tax Rates, and Dividends – add these as necessary

Check your Cash Flow “Cash at End of Period balances.” Continue editing your revenue and expenses until you create cash flow balances that will work for your company. Each time you make a change in a Financial Table, it dynamically updates your Cash Flow balances.

Check your Cash Flow “Cash at End of Period balances.” Continue editing your revenue and expenses until you create cash flow balances that will work for your company. Each time you make a change in a Financial Table, it dynamically updates your Cash Flow balances.- Tip: Reduce your sales and expenses to the lowest possible amount during the period your business will be in crisis and then be conservative in the later months, as you feel business might ramp back up.

- When you get your forecast to a state that is manageable for your company and projected cash balances are positive, find the expenses in your forecast that will qualify for loan forgiveness. Compare this sum to the amount you are eligible for. The difference is what you’ll be left with on the loan. Step 3 covers how to model the loan forgiveness in LivePlan.

As you build this scenario you may find that the business will not be profitable in the current year, which is very possible. But cash balances need to be forecast above zero, so the business can cover expenses. If cash balances are still negative after inserting the PPP loan you will need to go back to revenue and expenses and see whether there are any more adjustments you can make to reduce the need for cash.

Step 5: Apply for the PPP loan with confidence and manage the business using your plan

Now that you have a plan for your PPP loan, you can jump right into the application and work with your bank to submit it.

This section outlines steps for keeping your client’s forecast updated and using it to manage the business. This work is fundamental to the LivePlan Method for LivePlan Strategic Advisors. If you want to learn LivePlan, you can start a free trial and take our training program.

- Check back with the forecast regularly. Keep it updated monthly as anything changes in the business with revenue, expenses, personnel, etc. and edit the Financial Tables as needed.

- Use the forecast to manage profit and cash, and keeping it updated will help. It will continue to be a tool for managing the business if it’s kept up to date.

- Use the forecast as a goal for sales and the plan for monthly expenses. And the more regularly you update it, the more informed your goals will be.

- Continue monitoring the Cash Flow Forecast’s monthly cash balances and use it to monitor and predict cash runway.

- If LivePlan is not yet synced to the business’s accounting solution and you use QuickBooks or Xero, you can connect it in the Dashboard, and track the forecast versus actual results there. You can also prepare and print reports for client meetings.

Help your clients follow their plan and they’ll have confidence in the decisions they need to make to manage their business.